In today’s post, I’d like to cover off on SAP Business One Debtor Management that whilst it is not overly exciting, is very practical and can have an impact on your business bottom line.

For most businesses that operate on low or average margin, bad debt has a very significant impact on profitability and so it is well worthwhile to take every step possible to reduce the likelihood of bad debt as well as the actual write-offs caused by bad debt.

Every cent counts when margins are tight….debt management is critical

In my experience, one of the most important things that you can do as a small or mid-size business owner or as the person responsible for managing debt in the business is to take a proactive approach to managing that debt.

Let me give you a few examples – 3 in fact.

Combination Invoice and Statement

Doing simple things such as adding a mini statement to the bottom of every invoice that goes out to an existing customer can act as a simple reminder to that customer that may help ensure that when they are deciding who they need to pay that your debt is top of mind. Adding this information is very very easy to do with SAP Business One Debtor Management by using the report writer built into the solution and of course you can get even more sophisticated and attractive reports by utilising Crystal Reports to build your marketing documents like invoices, credit notes and so on.

Another feature built into SAP Business One is the ability to automate the process of sending debt reminder letters as well as, when appropriate, automatically levying finance charges on outstanding debts when part of your trading terms.

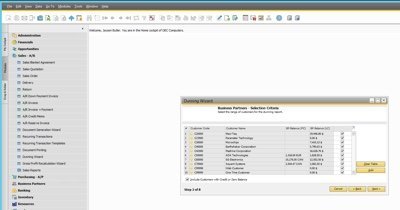

Dunning Letters

Known as Dunning letters these documents can be generated automatically based on a number of different parameters that you set inside SAP Business One and again using the concept of reminders, one successful strategy I’ve seen deployed in a number of businesses involves sending out dunning letters that list upcoming invoices that are due for payment in a friendly, nonthreatening manner as often many business debts are unpaid because of oversight rather than deliberate choice not to pay – in this respect I’m a big believer in the squeaky wheel get’s the first oiling concept.

The Dunning Wizard in SAP Business One makes the process extra easy

SAP Business One Debtor Management helps you to run the process with a wizard that allows you to build the parameters and save them in to a set for easy running any time you need to.

Customer Loyalty and Rewards

The third area that’s worth considering is implementing a reward style program that encourages “good behaviour” through the process of awarding points for the activities that you want your customers to participate in and then when they reach a certain number of points awarding prizes or better still allowing them to select prizes based on the number of points they have accrued.

The great thing about SAP Business One is that simply by using features such as user-defined fields user-defined tables and formatted searches (non-programmers tools) you can quickly and easily develop this kind of functionality and using the standard report writer add points balances and messages to all of your marketing documents such as order confirmations invoices, credit notes and so on.

The team at Leverage Technologies are very familiar with using all these tools and with the Christmas break coming up it’s a good time to think about adding some of these processes and tailored solutions to your deployment in the new year.

Give the team a call on 1300 045 046 and one of the consultants or business analysts will be more than happy to talk with you about implementing one or more of these strategies and helping you along the way to reducing debt and boosting cash flow.

Leave A Comment